MobiTouch Switch - Banking Switch

MobiTouch is a versatile banking switch that allows financial transactions for both issuers and acquirers. The platform is robust, high-performance, and fully PCI DSS-compliant, ensuring the security of all payment transactions. MobiTouch’s multi-channel payment infrastructure is operated from a single platform, making it highly convenient to use. This platform is compatible with a wide range of financial institutions, including Nationalised banks, Commercial and central banks, Telecom Operators, National Financial Switches, and 3rd Party Payment Processors.

It provides seamless delivery of its services, making it an ideal choice for businesses that require a reliable and efficient payment solution.MobiTouch Switch can be easily integrated with any core banking system, Fraud & Risk prevention platform, alternate delivery channel, or other internal or external systems.

The MobiTouch Switch solution is a comprehensive suite of applications that can be used to manage a variety of self-service devices such as ATMs, POS, Kiosks, Cash and Cheque deposit terminals, and other devices that interact with customers directly. This terminal management solution provides a fully integrated, multi-vendor device management system that allows banks to configure, monitor, control, and manage their diverse self-service terminal networks. The solution is highly configurable and supports a wide range of new business services including fund transfers, cash and cheque deposits, mobile top-ups, biometric authentication, NFC, online bill presentment and payment, and card-less transactions.

The solution’s flexibility and functionalities as a multi-institution switch allow users to either have their machines, such as the card production module and Hardware Security Module (HSM), or deploy the same set of hardware shared across multiple institutions.

Key Highlights of MobiTouch

- Multi-tenant, Multi-Currency, Multi-lingual,and Multi-Channel Support

- PCI PA-DSS Complaint

- Fully Compliant with EMV standards

- Highly Scalable & Modular for Planning of TPS/TPM

- Card to Customer-CentricArchitecture

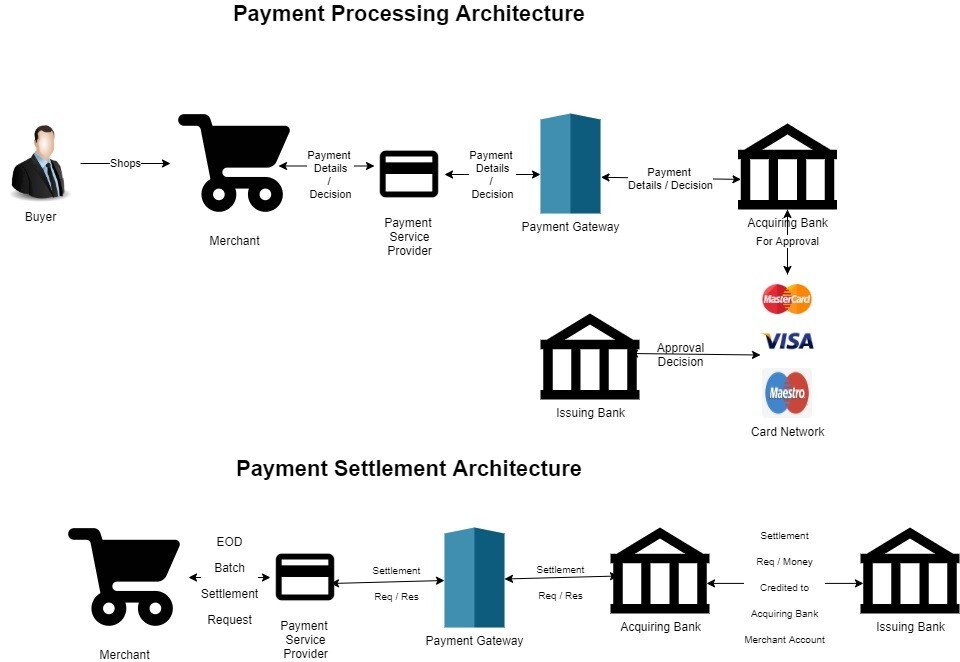

- Supports Clearing and Settlement with all international and domestic payment schemes

- Business Analytics Dashboard ensures informed decision-making