Banking & Financial Service

Banking and Financial Services play a crucial role in any country’s economy, contributing to social stability, employment, and economic growth. “iSM Technologies” offers global Digital Banking and Financial Service technologies with advanced analytic capabilities and tailored solutions for various BFSI products and services thereby leveraging traditional methodologies to create a secure, risk-free, and transparent digital platform.

Our platform uses the True Micro-Service architecture and runs on a No-Code Low-Code platform.

It is designed to comply with the guidelines of PSD2, GDPR, and RBI. The platform offers complete support for API-based integrations for M-banking and Web-Banking, catering to various use cases in the global market. We offer a secure platform that complies with Multi-Factor Authentication, cyber security, VAPT, database security, compliances, and local regulations.

We specialize in various Fintech products & services such as Global Digital Wallets, Agency Banking, Micro-ATM,Banking Switch, IBMB, Middleware Services, IT & IT IT-enabled services, Software Product Engineering, Mobility,Door Step Banking, Financial Literacy Centre, White-Level Product, Bio-Metric Onboarding, Customer Relationship Management, ERP, Big Data Consulting, Data Modelling,and Planning, UI/UX, Database Management, Cloud Integrated DevOps, Cloud Automation, Supply Chain Planning &Optimization, Product Lifecycle Management, SaaS, Card Management System, Loyalty & Rewards,BI Tool etc.

When it comes to the Indian BFSI market, we collaborate with various government agencies such as NPCI, UIDAI,and guidelines of RBI, IBA, etc. to provide our clients with top-notch, end-to-end technology-driven solutions for various use cases, process re-engineering, and AI implementation.

We are pioneers in delivering FinTech productsand servicesto Nationalised Bank, other Banks, NBFC, SFB, SACCO, Co-Operatives, Urban Co-Operative Bank, District Central Co-Operative Bank, Financial Institutions,InsureTech, etc.and We are highly accredited by our potential clients.

Digital Financial Solution (DFS)

iSM Technologies provides Digital Financial Solutions that fulfill the demand & supply needs of Telco, Financial Institutions, Banks, Sacco, Co-Operatives, etc. DFS platform deals with the latest technology including AI/ML, NLP, etc. Digital Financial Solutions (DFS) majorly deals in Middleware Services, Core Banking Systems, Banking Products & Services, CASA Management, Transfer & Remittances, Interoperability,Remittances, BBPS, UPI, AEPS, IMPS, NEFT, RTGS, Database Management, Managed Services, Risk & Fraud Prevention, Card Management System, IBMB, Asset Management, Micro-ATMs, andValue-Added Services.

Global Digital e-Wallet

“MobiTouch” is an in-house digital wallet platform that caters to both business users (customers, agents, merchants, Enterprises) and backend system users (admin, finance manager, support engineer). The platform is highly modular and scalable, designed using the True Micro Service platform. It offers several features such as escrow accounts, financial settlements, e-KYC level, user onboarding, and various use cases like P2P transfers, request money, QR payments, telco products, bill payments (electricity, telco post-paid, government taxes, etc.), micro-saving, goal-based saving, Loan Products, loyalty, and rewards, etc.

MobiTouch Platform is capable of processing transactions ranging from 10TPS to 200TPS and it ismulti-tenant, Multi-lingual & multi-currency. The platform’s data protection policy complies with local& Global regulations and All transaction(s) are end-to-end encrypted.

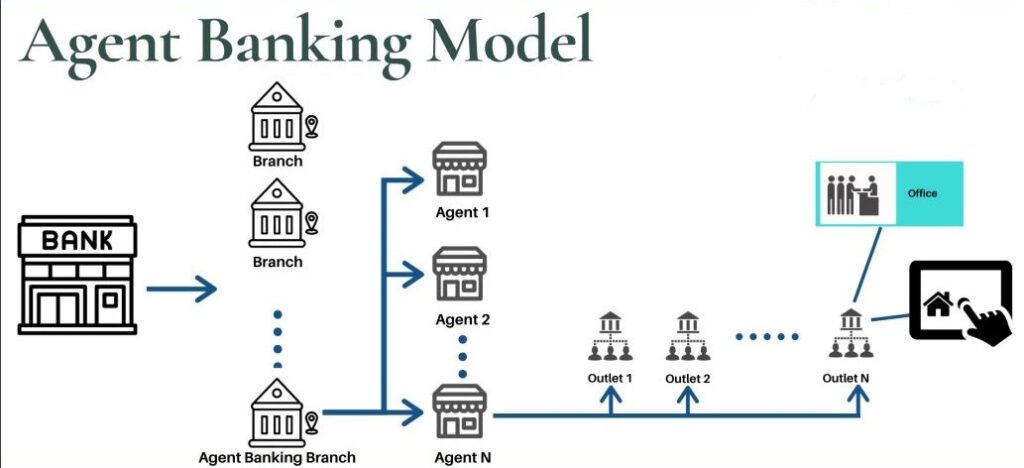

Agency Banking Solution

Financial Inclusion (FI) has revolutionized the banking system for rural &remote areas, providing access to banking products and services for last-mile persons.

Our Agency banking platform is built on a True Micro-service architecture, designed for both agents and system users.

We manage Agent Hierarchy, Settlement Accounts, Local Regulations&Compliance, and offer a wide range of Use Cases, including CashIn, CashOut, Bill Payment, Telco Recharge, Remittances, Merchant Payment, Fund Transfer (P2P, P2NR, P2B, P2W), Deposit, Withdrawal, Mini-Statement, Service Request, Loan Request, and many more.These services can be accessed through Mobile, Web, PoS, Tablet, etc.

Our platform is fully PCI-DSS compliant and complies with GDPR policies. The Platform hardware is designed from 2TPS to 150TPS, covering small to large volumes of transactions.

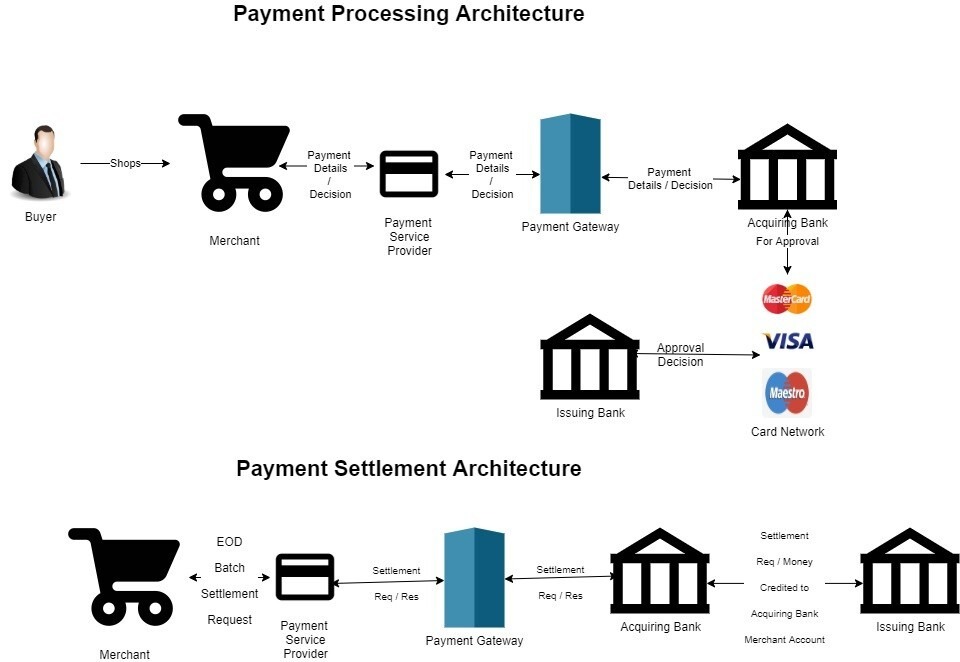

National Payment Switch-MobiSwitch

MobiSwitch is an in-house financial transaction switch that works in conjunction with banks to facilitate various financial and non-financial transactions. The primary objective of this Banking Financial Switch is to improve the efficiency of electronic banking services by acting as a centralized hub that connects various banking channels such as Automated Teller Machines (ATMs), Point-of-Sale (POS) terminals, online banking systems, mobile banking applications, etc.

This ensures interoperability, transaction routing, enhanced security, settlement processes, and transaction monitoring and reporting. The architecture of the “MobiSwitch” Platform manages transactions for both issuers and acquirers.

Reporting & Business Analytics

Reporting and business analytics (BA) are two sides of the same coin, working together to turn data into actionable insights for better decision-making. While reporting presents historical data in a structured format, BA delves deeper to uncover hidden patterns, trends, and relationships within that data. MobiView tool containing Graphs, pie charts, and analytics shows the nature of transactions, and these results in sales force decisions & business forecasting.

Security and Compliances

Security is a safeguard system against “Data” from unauthorized users, and disclosure. We manage and control the Encryption process, Access Control, Authentication, and Security Policy Such as Network, Security, Information Security, Physical Security, Cyber Security etc.

Adhering to laws, regulations, and standards is vital for compliance in an organization’s operations and industry keeping consideration of GDPR, HIPPA, and PCI-DSS.

Security and compliance are two crucial elements that are intertwined in ensuring the integrity, confidentiality, and availability of data and systems while adhering to legal and industry standards.